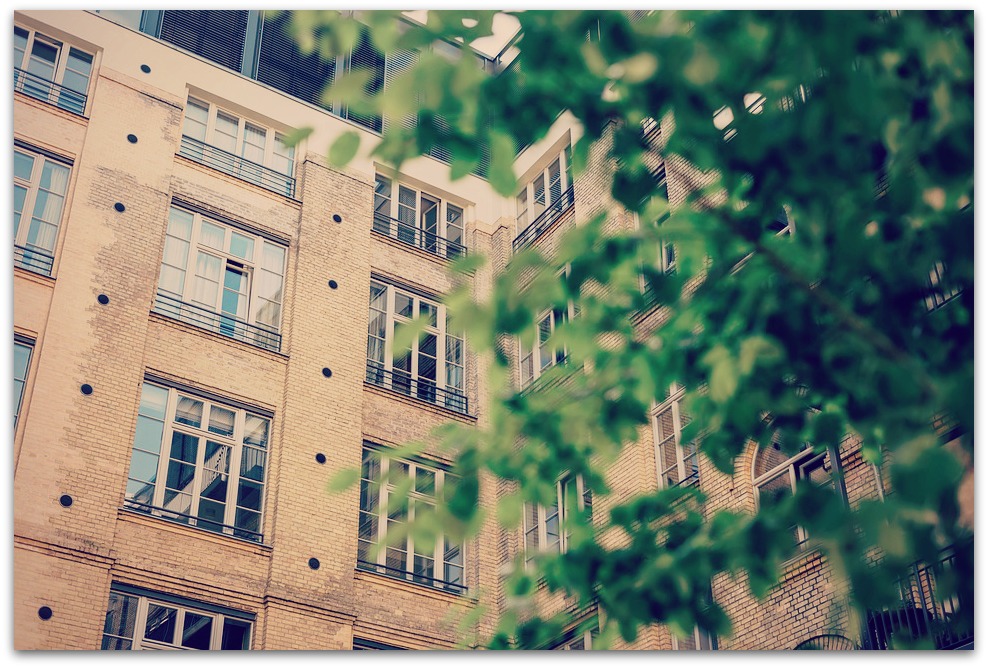

Are you about to invest unreal estate

? Whether you are buying or renting, this is an investment that should not be taken lightly. Of course, it is a matter of taste, location and budget. And we can never say it enough, this type of investment is a safe haven, especially in times of crisis.

And if you’re planning to buy in France, there are a few things you should consider carefully. For example, choose the location in relation to the market trend. To help you, here are a few points I have listed: investing in Île-de-France, investing in the provinces and the contrast in French real estate.

Investing in France, yes, but where?

The property market in Île-de-France

With an increasingly attractive balance sheet, the property market

is looking more and more promising for the years to come. With prices falling slightly, increasingly advantageous credit rates and legal incentives, several arguments have enabled the sector to experience a real boom. This year is therefore a very good year to invest.

Last year’s property market balance sheet was based mainly on the well-known causes: very low interest rates, a relative fall in property prices, tax incentives, etc. However, investment in French and Parisian real estate has always been a special case. Indeed, prices have always been high in this area. Now, in 2015, the market has also seen a decline.

So yes, the price trend is down in these areas. And in the whole of the Paris region. But that doesn’t stop the capital from taking first place in real estate sales prices. On average, you can expect to pay between €7,737 for a flat and almost €7,839 for a house.

Not surprisingly, it is therefore real estate that has made the most sales figures in the past year. With almost 15% growth in volume, the market in this area is benefiting from an extremely favourable situation. This can also be explained by the return of foreign investors, who are also encouraged by falling prices and an attractive exchange rate.

But for the average person, buying in the Île-de-France region requires certain conditions to be met: significant income, substantial personal contributions and financial stability. But also other parameters, which are not always economic, for example, the fact that a property investment in Paris

takes about twenty years to be profitable. And even if you manage to meet all the conditions for the purchase, you still have to go in search of all the sound advice given by the specialist agencies.

Finally, as for the rest of the Paris region, outside of Paris itself, it all depends on the geographical area you have chosen. There are great disparities in the Île-de-France, but you can find good deals, especially with the prospect of the Greater Paris project.

This project will indeed contribute to significantly changing the landscape of the Île-de-France. It could even transform the real estate market in this area. The Greater Paris project will be able to bring certain localities out of their rut and attract the interest of more investors. As a result, there will surely be an increase in prices in the areas that will be affected by the new public transport network. This network consists of 4 new metro lines, 2 major extensions of existing lines, and 72 stations.

The property market in the provinces

Even if real estate in the capital is very popular, investment in Paris is not accessible to all French people because the price per square metre is far too high. Do you want to buy a property? Consider investing in the provinces

, as this is by far the best solution. But you will still have to choose the cities where you will invest.

The south of France is a charming destination that is attracting more and more investors. Bordeaux, for example, has long been a very famous place to live. The population has exploded in the last few years. There is also a great deal of interest among the French in property investment. As a result, there has been a strong increase in prices, more than 80% in 10 years. If you are looking for small flats, you should prepare, for T2 or T3, around €135,000. In addition, the neighbourhoods around the Bataclan offer a square metre at €2000. If you want to learn more about negotiation and lower the price of your future property, take the time to read this article: being a good negotiator.

As for the city of Rennes, it sees an influx of people who want to make a rental investment. This is why small surfaces are rare. However, with the construction of the new metro line, it is preferable to favour the residential areas near Longchamp, Gare Sud and Cleunay.

If you are planning to invest in the provinces, you will obviously need to consider the Toulouse option. For example, the Midi-Pyrénées has a population of around 380,000. This makes it the fourth most populated city in France. This metropolis attracts people thanks to its dynamism, but also for its tourist appeal.

Investing in a house in the provinces by the beach

The contrasts in the French property market

This may be very good news for buyers:property prices in France

have been falling steadily since 2014. On average, there has been a 2.2% fall over the last year. Sales volumes are also down slightly, with almost 710,000 transactions last year, a drop of 2%. In the absence of an economic recovery, buyers are taking a wait-and-see attitude, even though the market is clearly more favourable thanks to the very attractive mortgage rates.

But this average decline in prices hides a geographical reality full of contrasts. For example, in some cities, prices continue to rise. For example, in Bordeaux, the price of a flat has risen by 4.5%, while it has only risen by 2.5% in Strasbourg and 2% in Nîmes. And in the major cities (Nantes, Lyon) prices are fairly stable.

Finally, prices have fallen sharply in cities with major economic problems and in rural areas. But not only that, as prices have also fallen slightly in Paris and the Île-de-France. In the capital, the price has fallen to an average of around €7,000/m².

Nevertheless, Paris and the Île-de-France still lead the way in terms of the highest prices. Fortunately, demand is still very strong in this region, as the capital still attracts investors. This is due to its economic dynamism as well as the city’s proximity to all activities. However, the people of Île-de-France are no longer prepared to invest a small fortune following a first love affair. As proof, transactions are slowing down considerably and are down by 9%. And the small drops are not reaching young households.

Nearly an hour away by TGV, the Lille metropolis offers slightly more reasonable prices. On average, you can expect to pay around €2,800/m² for a flat. But this obviously varies according to the neighbourhood you choose. But the softest prices are those found in the city of Normandy. The range is between 1300 and €2700 / m². This contrast can be very advantageous for some and less so for others.

Recent Comments